Starting a credit repair business in Florida offers a promising opportunity to entrepreneurs looking to enter a high-demand industry.

With a growing awareness of the importance of credit health, the demand for credit repair services is on the rise.

This guide will walk you through the steps to launch a successful credit repair business from home or as a credit repair franchise in the Sunshine State, ensuring you comply with local regulations and become a certified credit repair specialist.

Our Verdict

- Comply with all federal and state laws, including the Credit Repair Organizations Act and the Florida Credit Service Organizations Act.

- Obtain a local business license or permit if required by your city or county.

- Get a $10,000 surety bond to meet Florida's requirements for credit repair businesses.

- Draft a clear and compliant contract outlining services, fees, and cancellation policy based on CROA and Florida law.

- Develop marketing materials that educate consumers about credit repair and the benefits of your services while complying with FTC advertising rules.

- Keep accurate and detailed records of all client transactions for at least two years.

- Consider obtaining Errors and Omissions (E&O) insurance

- Do not charge clients before providing services, as per the Credit Repair Organizations Act.

- Don't guarantee specific credit score improvements or claim affiliation with credit bureaus.

- Do not engage in any activities that could be considered as practicing law unless you are properly licensed.

- Avoid misrepresenting your affiliation with credit reporting agencies or any other organizations.

- Don't advise clients to dispute accurate credit information or create false identities. pen_spark

- Don't skip the surety bond - it protects clients if you fail to deliver services.

- Do not forget to include your registration number in all advertisements if required by local regulations.

1. Understand the Legal Landscape: Is Credit Repair Legal in Florida?

Yes, credit repair is legal in Florida. However, it’s governed by both federal and state laws designed to protect consumers from fraudulent practices.

Before you start your credit repair business in Florida, familiarize yourself with the Credit Repair Organizations Act (CROA) and Florida’s Credit Service Organizations Act.

These laws require disclosure agreements, prohibit upfront fees, and outline what credit repair organizations can and cannot do.

Calculate your business expenses here:

Budget Calculator

Required Equipment and Average Cost

- Computer: A reliable computer is essential for managing client data, processing reports, and communicating with clients. Average cost: $500 – $1500.

- Printer/Scanner: Needed for printing and scanning documents such as credit reports, contracts, and letters to credit bureaus. Average cost: $100 – $300.

- Phone System: A dedicated phone line or a VoIP service for communicating with clients and creditors. Average cost: $30 – $100 per month.

- Software: Credit repair software for managing client accounts, generating dispute letters, and tracking progress. Average cost: $50 – $200 per month.

- Website: A professional website to showcase services, attract clients, and provide educational resources. Average cost: $500 – $2000 for design and development, plus hosting fees.

Get Your Domain & Hosting at an 80% Discount!

Flat 80% off on domain & hosting. Limited-time deal!

- Office Furniture: Desk, chair, filing cabinets, and other furniture for setting up a professional workspace. Average cost: $500 – $1500.

- Internet Connection: High-speed internet access for conducting research, communicating with clients, and accessing online resources. Average cost: $50 – $100 per month.

- Security Measures: Data security software, firewalls, and encryption tools to protect sensitive client information. Average cost: $100 – $500 per year.

- Credit Reports: Subscription to a credit reporting agency for accessing client credit reports and monitoring changes. Average cost: $20 – $50 per month per client.

- Marketing Materials: Business cards, brochures, and promotional materials to market your services locally. Average cost: $100 – $500.

- Legal Documents: Contracts, client agreements, and legal forms prepared by a lawyer to protect your business and clients. Average cost: $500 – $2000 for initial setup.

- Accounting Software: Software for managing finances, tracking expenses, and generating invoices. Average cost: $20 – $50 per month.

- Training Materials: Books, online courses, and workshops to stay updated on credit repair laws and best practices. Average cost: $100 – $500.

- Office Supplies: Pens, paper, envelopes, and other stationary for day-to-day operations. Average cost: $50 – $200.

- Business Insurance: Liability insurance to protect your business from potential lawsuits and claims. Average cost: $500 – $2000 per year.

- Professional Membership: Joining professional associations or networks for networking opportunities and access to resources. Average cost: $100 – $500 per year.

Remember, these costs can vary based on factors such as location, business size, and specific needs. It’s also important to budget for ongoing expenses such as software subscriptions, marketing, and client acquisition.

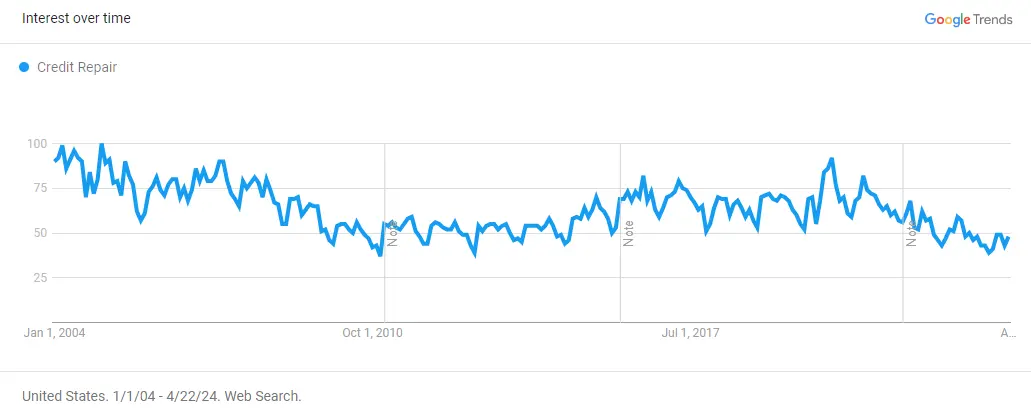

Market Analysis of Credit Repair Industry

According to Moneyzine, The credit repair industry in the United States has seen fluctuating trends and holds a significant market size.

In 2021, the US credit repair market was valued at $4.02 billion, with a projection to reach $4.4 billion in 2022, indicating a 9.5% year-over-year increase.

Despite this growth, the industry has experienced negative growth of -3.2% per year from 2017 to 2022, reflecting a decrease from nearly $5.2 billion in 2017.

The industry comprises a substantial number of businesses and employees, with 44,730 credit repair companies in 2021 and a projection of 43,791 companies in 2022.

This represents a loss of nearly 1,000 companies, marking a 2.1% year-over-year decrease.

The number of businesses has diminished by 6.7% annually from 2017 to 2022. In terms of employment, the industry had 50,935 employees in 2021, with wages totaling $1.52 billion for that year.

Future of Credit Repair

The demand for credit repair services is driven by a significant portion of the population needing credit improvement.

Approximately 16% of Americans have a poor credit score (300–579) according to the FICO credit score scale, translating to more than 53.3 million Americans in need of credit improvement.

Furthermore, consumer behavior indicates a strong reliance on credit repair services, with 42% of US consumers believing these services are helpful in correcting credit report errors.

How Effective is Credit Repair?

The effectiveness of credit repair services is notable, with 88% of users reporting significant increases in their credit scores.

Most users, specifically 36.7% for up to five months and 48% for six months or more, added more than 100 points to their credit scores.

Collections were the most commonly removed items from credit reports, contributing to credit score improvements.

According to a report by Screen & Reveal, consumer-related statistics reveal that about 48% of consumers who hired a credit repair company saw an increase of 100+ points on their credit score after using the services for six or more consecutive months.

Additionally, 32% of consumers have spent over $750 on credit repair services, with a notable percentage reporting a significant increase in their credit scores as a result.

Forecast and Future Trends

The US credit repair industry is characterized by its significant impact on individuals seeking to improve their credit scores, despite facing challenges such as a declining number of companies and employees in recent years.

This involves submitting an application, paying a registration fee, and obtaining a surety bond. The surety bond protects consumers in case your business fails to comply with legal standards. You might want to hire a business formation service to assist in this step.

2. How to Get a Credit Repair License in Florida

While there’s no specific “credit repair license” required in Florida, you must register your business as a Credit Service Organization (CSO) with the state.

This involves submitting an application, paying a registration fee, and obtaining a surety bond. The surety bond protects consumers in case your business fails to comply with legal standards.

3. Develop a Business Plan and Choose Your Structure

Crafting a detailed business plan is crucial for your credit repair business startup.

Decide whether you want to start a credit repair business from home, become part of a credit repair franchise, or establish an independent Florida credit firm.

Your business plan should outline your target market, services offered, pricing strategy, and marketing plan, incorporating SEO strategies to rank for keywords like “credit repair Florida,” “Florida credit firm,” and “start credit repair business.”

4. Financial Planning and Budget

Creating a financial plan for a credit repair business in Florida, or any location, involves careful consideration of several key components, including startup costs, pricing strategy, funding options, and insurance requirements. Here’s a breakdown of these essential elements:

1. Startup Costs

Startup costs for a credit repair business can range from a few hundred to several thousand dollars, depending on whether you work from home or lease office space, your marketing budget, and the technology or software you choose to use.

Common initial expenses include:

- Surety Bond: In Florida, a $10,000 surety bond is required, with costs varying based on credit, ranging from 1% to 10% of the bond amount annually.

- Legal and Licensing Fees: Costs will vary by location; checking with local city and county offices is necessary for exact figures.

- Software Subscriptions: Credit repair software platforms can range from $30 to $300 per month, depending on the features and scale of operations.

- Marketing and Advertising: Initial costs can vary widely, from a few hundred dollars for basic website and social media setup to thousands for comprehensive digital marketing campaigns.

- Office Supplies and Equipment: If operating from an office, costs for furniture, computers, phones, and office supplies. You can also choose to get a virtual office when you’re just starting out instead of getting a separate building.

- Insurance: Professional liability insurance to protect against potential lawsuits.

2. Pricing Strategy

Pricing can be structured in various ways, such as monthly subscription fees, pay-per-deletion, or a combination of both.

It’s crucial to set prices that are competitive yet sustainable for your business model.

Research the market to understand what competitors charge and consider your value proposition to justify your pricing.

- Monthly Fees: Common charges range from $50 to $130 per month, depending on services provided.

- Pay-Per-Deletion: Charges can range from $35 to $150 per deletion, varying by the difficulty and level of service.

3. Funding Options

Funding for your business can come from several sources:

- Personal Savings: Many small business owners start with their own money to cover initial costs.

- Small Business Loans: Banks and credit unions offer loans specifically for small businesses.

- Investors: You may seek investment from friends, family, or angel investors who believe in your business concept.

- Grants: Some government and private grants are available for small businesses, especially those operated by minorities, women, or veterans.

4. Insurance

Insurance is critical to protect your business and personal assets. Types of insurance to consider include:

- General Liability Insurance: Covers injuries or property damage caused by your business operations.

- Professional Liability Insurance (E&O): Protects against claims of negligence or harm due to professional services or advice provided.

- Cyber Liability Insurance: Important if you’re storing sensitive client data digitally, protecting against data breaches and cyber-attacks.

5. Financial Management and Projections

Develop a comprehensive financial plan that includes detailed projections for revenue, expenses, and profit margins.

Use conservative estimates to plan for slow periods and unexpected costs.

Regularly review your financial performance and adjust your strategies as needed to ensure profitability and growth.

For a better result, calculate your business expenses here:

Budget Calculator

6. Cash Flow Management

Maintaining a healthy cash flow is crucial for the survival of any business.

Implement strategies to manage your cash flow effectively, such as setting aside a portion of revenues for future expenses, offering incentives for early payments from clients, and carefully managing your accounts payable.

Tax Planning

Understand your tax obligations and plan accordingly. By registering your business, you’ll be able to qualify for an EIN which is necessary for tax purposes. You can easily order your federal employer identification number (EIN) online. This number is issued by the IRS and is necessary for businesses.

This may involve setting aside a portion of your income for taxes, keeping thorough records of all business transactions, and possibly hiring a tax advisor to ensure compliance and take advantage of potential tax benefits.

5. Becoming a Certified Credit Repair Specialist

To establish credibility and trust with your clients, consider becoming a certified credit repair specialist.

Various reputable organizations offer certification programs that teach the laws governing credit repair, ethical practices, and effective strategies for improving clients’ credit scores.

Certification can give you a competitive edge in the industry and reassure clients of your expertise.

6. How to Open a Credit Repair Business: Building Your Brand

Choosing the right credit repair business name is vital for brand recognition and SEO. Your name should be memorable, reflect your services, and include keywords like “credit repair FL” or “start credit restoration business” to improve online visibility.

Develop a professional website and utilize SEO techniques to attract clients searching for “how to do credit repair” or “how to become a credit repair specialist.”

7. Marketing Your Credit Repair Services

Effective marketing is key to attracting clients to your credit repair company. Utilize digital marketing strategies, including SEO, content marketing, and social media, to target potential clients.

Focus on keywords like “how to start your own credit repair business” and “how to become a certified credit repair specialist” to capture the attention of individuals seeking to enter the industry or improve their credit scores.

To market a credit repair business effectively, focus on these strategic approaches:

- Digital Marketing: Utilize SEO to improve your website’s visibility for credit repair-related searches. Engage in PPC advertising to target potential clients actively searching for credit repair services.

- Social Media Presence: Build a strong presence on platforms like Facebook, Instagram, and LinkedIn. Share success stories, testimonials, and tips on improving credit scores to engage your audience.

- Content Marketing: Create valuable content such as blog posts, infographics, and videos that help demystify credit repair, positioning your business as a trusted authority in the field.

- Referral Programs: Encourage satisfied clients to refer others by offering them incentives, such as a discount on future services or a small reward for each referral.

- Partnerships: Establish relationships with local real estate agents, mortgage brokers, and car dealerships. These professionals encounter clients with credit issues and can refer them to your services.

- Reviews and Testimonials: Collect and showcase reviews and testimonials from satisfied clients to build credibility and trust with potential customers.

- Email Marketing: Use email newsletters to keep in touch with potential and current clients. Provide useful content, updates on credit repair laws, and special offers to keep your audience engaged.

8. Legal Compliance and Best Practices

Ensure your services comply with federal and state laws. Provide clear contracts, perform services as promised, and avoid making unrealistic guarantees.

Educating clients on their rights and how to maintain good credit can further bolster your reputation and success.

To start a credit repair business in Florida, you’ll need to navigate through a variety of licenses and permits to ensure legal compliance. Here’s a summary of what you’ll need and where to get them:

- Local Business License or Permit

Depending on your location within Florida, you might be required to obtain a local business license or permit. The specific requirements vary by city and county, so it’s best to check with your local government offices.For details on licensing and the Office of Financial Regulation’s requirements, you can visit the Florida Office of Financial Regulation website.

- Sales Tax Permit

If you’re selling tangible personal property or certain services, you may need a sales tax permit from the Florida Department of Revenue. This is applicable if you’re offering products like credit reports or credit monitoring services.

- Professional License

Should your credit repair services include legal advice or activities that could be construed as the practice of law, obtaining a professional license from the Florida Bar or the relevant regulatory agency will be necessary.

- Written Contracts

Florida mandates that credit repair organizations provide clients with a detailed written contract. This contract must outline the services provided, total costs, contract duration, and include a cancellation notice among other disclosures.

- Surety Bond

You’re required to obtain a surety bond or maintain a trust account in the amount of $10,000. This serves as a financial safety net for your clients, ensuring you can fulfill your obligations.

- Advertising Compliance

Ensure that all advertising complies with regulations, avoiding false or misleading statements and including your registration number in all advertisements. This number is issued by the Florida Office of Financial Regulation.

9. Registration and Contracts

Registration for Credit Repair Business in Florida

Florida does not specifically require credit repair businesses to register as Credit Service Organizations (CSOs).

However, adhering to the Florida Credit Service Organizations Act is mandatory. It’s also important to consult with the Florida Department of State and the Florida Office of Financial Regulation to verify if there are any other registration or licensing requirements specific to your business operations.

Local business licenses or permits may be required depending on your location within Florida, so checking with your city or county government is advisable.

Contract Requirements under CROA

Credit repair businesses in the U.S. are regulated by federal laws, notably the Credit Repair Organizations Act (CROA) and the Telemarketing Sales Rule (TSR).

Credit Repair Organizations Act (CROA): Enacted in 1996, this law prevents credit repair companies from misleading or defrauding consumers. It prohibits:

- Misleading consumers about their credit history.

- Advising clients to create a false identity.

- Charging for services before they’re delivered.

Contract Requirements under CROA:

Credit repair companies must provide a written contract that includes:- A disclosure of consumer rights under state and federal law.

- A description of the services to be provided.

- An estimate of the time required for service completion.

- A notice of the consumer’s right to cancel within three business days, with duplicate cancellation forms provided.

Telemarketing Sales Rule (TSR): If you solicit business across state lines, compliance with the TSR is required. It governs how you market your services and collect fees, ensuring transparency and consumer protection.

Florida-Specific Contract Requirements

In addition to federal regulations, Florida has its own specific statutes regarding credit repair contracts under Fla. Stat. §817.704.

Florida regulates credit repair businesses under the Florida Credit Service Organizations Act, Fla. Stat. §817.7001 et seq. Key points include:

Bond Requirements: Florida mandates a $10,000 surety bond to protect consumers in case of business malpractice. The cost of obtaining the bond depends on your credit score, generally ranging from 1% to 10% of the bond’s value annually.

Licensing: While Florida does not currently require a specific credit repair license, local governments (cities or counties) may mandate business licenses. Check with your city or county officials to ensure compliance.

CSO Registration: Florida does not require CSO registration. However, stay updated with the Florida Department of State and Office of Financial Regulation for any changes.

Credit Repair Contracts:

Under Florida law (Fla. Stat. §817.704), credit repair contracts must allow consumers to cancel within five days of signing. Businesses must issue a full refund within 10 days of receiving a cancellation notice. The contract must also include specific disclosures regarding the services offered and the consumer’s rights.

Compliance and Best Practices

Ensuring compliance with both federal and state laws regarding registration and contracts is crucial for operating a legitimate and trustworthy credit repair business.

It’s advisable to regularly review the latest regulations and seek legal counsel to avoid any potential legal issues.

Practicing transparency with clients by providing clear, detailed contracts that comply with the CROA and Florida-specific requirements will help build credibility and trust in your services.

Remember, while this overview provides a solid foundation, laws and regulations can change, so continuous education and legal consultation are key to maintaining compliance and protecting your business and your clients.

FAQs

- Is a special license required to start a credit repair business in Florida?

No specific credit repair license is required in Florida, but you must comply with local business licenses or permits based on your city or county.

- Do I need to register as a Credit Service Organization (CSO) in Florida?

Florida does not currently require credit repair businesses to register as CSOs, but check for any updates or local requirements.

- What laws must a credit repair business in Florida comply with?

You must comply with the federal Credit Repair Organizations Act (CROA) and the Florida Credit Service Organizations Act, among other applicable state and federal laws.

- How much can I charge my clients for credit repair services?

Pricing varies; research competitor pricing, but stay flexible. Charges can be monthly or per deletion, with larger companies often charging $90 to $125 per month.

- Do I need a surety bond to operate a credit repair business in Florida?

Yes, Florida requires a $10,000 surety bond for credit repair businesses.

- What should be included in a credit repair contract in Florida?

Contracts must include services to be provided, total cost, duration, a disclosure statement, and a cancellation policy as mandated by federal and state law.

- Can clients cancel a credit repair contract in Florida?

Yes, Florida allows consumers to cancel the contract within 5 days of signing, with a full refund required within 10 days of cancellation notice receipt.