In the burgeoning world of investment, real estate crowdfunding has emerged as a revolutionary way for individuals to pool resources and invest in property markets.

This approach democratizes real estate investment, making it accessible to a wider audience beyond traditional investors. If you’re looking to dive into this lucrative venture, starting a real estate crowdfunding business can seem daunting.

However, with the right guidance and understanding of the industry, including insights on CrowdStreet competitors and the mechanics of real estate crowdfunding in the USA, you can set the foundation for a successful startup real estate investment company.

Our Verdict

- Ensure legal compliance

- Prioritize platform security

- Consider alternative investment structures: Explore options beyond just equity offerings. Debt crowdfunding or revenue sharing models can be attractive to some investors.

- Focus on user experience

- Embrace technology for underwriting: Utilize AI-powered tools to analyze property data and automate aspects of due diligence, improving efficiency.

- Overlook community building: Foster a sense of community among investors. Regular webinars, Q&A sessions, or exclusive content can increase engagement and loyalty.

- Forget the exit strategy: Clearly outline potential exit options for investors (selling shares, property sale) before they invest.

- Promise unrealistic returns

- Neglect platform scalability

What is Real Estate Crowdfunding?

Real estate crowdfunding allows investors to contribute funds towards real estate investments, sharing in the profits and losses without the need to directly buy or manage properties.

This method has gained popularity, thanks to platforms that connect investors with real estate projects.

By offering a fundraiser account for real estate, these platforms provide a streamlined way for individuals to engage in real estate investment crowdfunding.

Types of Crowdfunding in Real Estate

Crowdfunding can be categorized into four main types, each with distinct characteristics and purposes:

- Reward-Based Crowdfunding: Backers contribute money to projects in exchange for tangible rewards or experiences. This type is popular for creative, entrepreneurial, and innovation projects on platforms like Kickstarter and Indiegogo.

- Equity Crowdfunding: Investors receive a stake in the company or project in exchange for their funding. This type is used by startups and businesses looking to raise capital without taking on debt.

- Debt Crowdfunding (Peer-to-Peer Lending): Contributors lend money to individuals or businesses with the expectation of getting their money back with interest. Platforms like LendingClub and Prosper facilitate this type of crowdfunding.

- Donation-Based Crowdfunding: Individuals donate to causes without expecting anything in return. This type is often used for charitable causes, personal fundraising efforts, or social projects on platforms such as GoFundMe.

- Blockchain-Based Crowdfunding (ICOs/STOs): It involves raising capital through the issuance of digital tokens on a blockchain. Investors purchase these tokens, which can represent a variety of rights, such as equity, dividends, or voting rights in the case of STOs, or more speculative value in the case of ICOs.

Each crowdfunding type serves different needs, from supporting innovative projects to investing in new businesses or lending money while earning interest.

Calculate your business expenses here:

Budget Calculator

Required Equipment and Average Cost

Starting a Real Estate Crowdfunding Business involves setting up a robust infrastructure that includes technology, legal frameworks, marketing, and office setup.

Technology Infrastructure

- Website and Platform Development:

- Custom Website Development: $5,000 – $20,000

- Crowdfunding Platform Software: $10,000 – $50,000

- Monthly Hosting and Maintenance: $100 – $500/month

- Domain Name: $10 – $50/year

- Web Hosting: $100 – $300/year

Get Your Domain & Hosting at an 80% Discount!

Flat 80% off on domain & hosting. Limited-time deal!

- SSL Certificate:

- SSL Certificate: $50 – $150/year

- CRM (Customer Relationship Management) Software:

- CRM Software (e.g., Salesforce, HubSpot): $25 – $300/user/month

- Payment Processing System:

- Payment Gateway Fees: 2.9% + $0.30 per transaction

- Cybersecurity Solutions:

- Firewall and Security Software: $500 – $2,000/year

- Data Analytics Tools:

- Analytics Software (e.g., Google Analytics, Tableau): Free – $1,200/year

Legal and Compliance

- Legal Fees:

- Initial Legal Consultation: $200 – $500/hour

- Setting Up Business Structure (LLC, Corporation): $500 – $2,000

- Regulatory Compliance and Documentation: $5,000 – $20,000

- Accounting and Financial Services:

- Accounting Software (e.g., QuickBooks): $25 – $150/month

- CPA Services: $1,000 – $5,000/year

Marketing and Sales

- Marketing Tools and Services:

- Digital Marketing (SEO, SEM, Social Media): $500 – $5,000/month

- Email Marketing Software (e.g., MailChimp, Constant Contact): $20 – $300/month

- Content Creation (Blogging, Video): $500 – $5,000/month

- Design Software:

- Adobe Creative Cloud: $52.99/month

Office Setup

- Office Space:

- Rent (varies by location): $500 – $5,000/month

- Office Equipment:

- Computers/Laptops: $500 – $2,000 each

- Monitors: $100 – $300 each

- Printers/Scanners: $100 – $500

- Office Furniture (desks, chairs, etc.): $1,000 – $5,000

- Communication Tools:

- VoIP Phone System: $20 – $50/user/month

- Internet Service: $50 – $200/month

Miscellaneous

- Insurance:

- Business Liability Insurance: $500 – $2,000/year

- Professional Memberships and Subscriptions:

- Real Estate and Crowdfunding Associations: $100 – $1,000/year

- Training and Development:

- Online Courses and Certifications: $200 – $2,000/year

Summary

- Low End: $50,000

- High End: $200,000

Breakdown

- Technology Infrastructure: $20,000 – $100,000

- Legal and Compliance: $6,700 – $27,500

- Marketing and Sales: $1,040 – $10,300/month

- Office Setup: $3,250 – $17,000

- Miscellaneous: $800 – $5,000/year

This investment can vary widely based on your business model, geographical location, and specific needs.

Step 1: Research and Understand the Market

Before launching your crowdfunding platform, it’s crucial to understand the real estate crowdfunding landscape.

Investigate the best real estate crowdfunding websites and study CrowdStreet competitors to identify what they do well and where there may be gaps in the market.

Familiarize yourself with the legal requirements for crowdfunding for real estate investments and the various real estate investing platforms available.

This foundational knowledge is key to differentiating your startup real estate investment company. So before you form a new company, keep these factors in mind.

Market Analysis and Growth

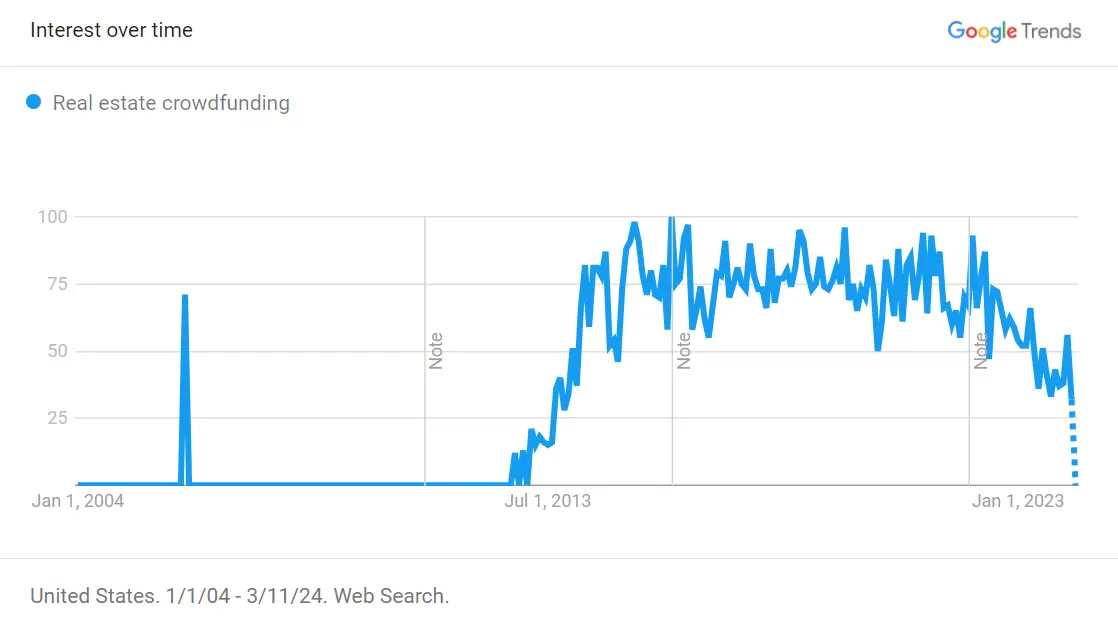

Real estate crowdfunding has experienced exponential growth over the past decade.

As reported by Vantage Market Research, In 2022, the global real estate crowdfunding market was valued at approximately $11.5 billion and is projected to reach $161.8 billion by 2030, growing at a compound annual growth rate (CAGR) of 45.9% from 2023 to 2030.

This surge is attributed to the increasing popularity of crowdfunding as an accessible form of investment, alongside growing investor interest in real estate as a means of diversifying portfolios and securing returns in a low-interest-rate environment.

Competitive Landscape: CrowdStreet Competitors and Market Players

The competitive landscape features a mix of established platforms like CrowdStreet, Fundrise, and RealtyMogul, alongside emerging startups.

These platforms vary in terms of investment offerings, fee structures, and target markets. Asia Pacific is the fastest growing region in this industry, with North America being the current largest.

Conducting a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) on key competitors can reveal market gaps and areas for differentiation for your startup real estate investment company.

Market Trends and Consumer Behavior

Trends shaping the real estate crowdfunding market include an increased focus on sustainability, the rise of blockchain technology for transaction security and transparency, and a growing preference for passive income streams among millennials.

Furthermore, the COVID-19 pandemic has accelerated interest in real estate crowdfunding, as investors seek more resilient investment opportunities outside of traditional stock markets.

Market Statistics, Figures, and Data

- Investor Demographics: A significant portion of real estate crowdfunding investors are millennials, representing about 48% of the total investor base. This demographic is attracted to the low entry barriers and the digital-first approach of crowdfunding platforms.

- Average Returns: Real estate crowdfunding platforms have reported average annual returns between 8% and 12%, outpacing many traditional real estate investment vehicles.

- Investment Volume: The number of active real estate crowdfunding platforms has grown to over 150 globally, with the United States being a major hub for activity.

Forecast and Opportunities

Looking ahead, the real estate crowdfunding market is poised for continued growth, driven by technological innovations and shifting investor preferences.

Emerging opportunities include expanding into untapped real estate sectors, such as industrial properties and affordable housing projects.

Additionally, international expansion presents a significant growth avenue, as investors seek to diversify their portfolios across global markets.

Step 2: Develop a Business Plan

A well-thought-out business plan is essential for any startup, and a real estate crowdfunding business is no exception.

Your plan should detail your business model, target market, marketing strategy, and financial projections.

Clearly define how your platform will operate, how it will generate revenue, and how it will provide value to both investors and property developers.

Choosing a Business Structure for Real Estate Crowdfunding

The optimum business structure for a real estate crowdfunding platform is typically a Limited Liability Company (LLC). To decide which structure suits you, consider hiring a business formation service.

An LLC offers a flexible management structure, which is ideal for startups navigating the complex regulatory environment of real estate and securities. Here are the key reasons why an LLC is a good option for this type of business:

- Limited Liability Protection: LLCs provide personal liability protection for their owners (called members). This means that members are not personally responsible for the business debts and liabilities of the LLC. Given the financial risks involved in real estate investments and the potential for legal disputes, this protection is crucial.

- Tax Flexibility: LLCs offer pass-through taxation, where business profits are passed through to members’ personal tax returns, avoiding the double taxation that corporations can face. Additionally, LLCs can elect to be taxed as a corporation if it becomes beneficial.

- Regulatory Compliance: An LLC structure can simplify compliance with SEC and state securities regulations. It can more easily adapt to the legal requirements for crowdfunding platforms, including those related to investor relations and fund management.

- Operational Flexibility: LLCs allow for a flexible management structure, which can be tailored to the specific needs of the business without the formalities and requirements of a corporation. This can be particularly beneficial for startups that need to make quick decisions in response to market or regulatory changes.

- Credibility with Investors: Forming an LLC demonstrates a commitment to professionalism and legal compliance, which can help build credibility and trust with potential investors and partners.

Register Your Business

- Choose a Business Name: Select a unique and legally compliant name for your business. Ensure it’s not already in use or trademarked by performing a search in your state’s business database and the U.S. Patent and Trademark Office.

- Select a Business Structure: Decide on the most suitable business structure for your platform. As mentioned earlier, a Limited Liability Company (LLC) is often recommended for its liability protection and tax flexibility.

- Register with the State: File the necessary documents with your state’s secretary of state office or equivalent. For an LLC, this usually involves submitting the Articles of Organization and paying a filing fee. The requirements and fees vary by state.

- Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS. It’s needed for tax purposes and to open a business bank account. You can get an EIN easily by ordering online.

- Register for Taxes: Register with your state tax authority for any applicable state taxes. This may include sales tax, payroll tax, and any specific taxes related to real estate or financial services.

- Secure Permits and Licenses: Obtain any required local, state, or federal licenses or permits. This can include a general business license, securities offering registration with the SEC, and any specific real estate investment or broker-dealer licenses.

- Comply with Securities Laws: If offering securities, ensure compliance with SEC regulations, which may involve registering as a funding portal or broker-dealer and adhering to the appropriate crowdfunding regulations.

- Local Compliance: Check for any local compliance requirements, including zoning laws, business operation permits, and local tax registrations.

Step 3: Legal Compliance and Registration

Understanding and adhering to the legalities of real estate crowdfunding is crucial. In the USA, this means complying with regulations set by the Securities and Exchange Commission (SEC) and potentially registering as a broker-dealer or a funding portal.

Consult with legal experts to navigate these requirements and ensure your platform operates within the law.

1. Business Operation License

Before you start any business, you’ll need a general business operation license, which is typically issued by the city or county where your business is located. This license authorizes you to conduct business within the local jurisdiction.

Where to Get It: Local city or county clerk’s office.

2. Securities and Exchange Commission (SEC) Registration

Real estate crowdfunding involves the offering of securities, which means your platform must comply with SEC regulations. Depending on your business model, you might need to register as a funding portal or broker-dealer with the SEC.

Where to Get It: Securities and Exchange Commission (SEC) via their Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system.

3. Financial Industry Regulatory Authority (FINRA) Membership

If your platform is required to register with the SEC as a broker-dealer, you’ll also need to become a member of the Financial Industry Regulatory Authority (FINRA), which is a non-governmental organization that regulates member brokerage firms and exchange markets.

Where to Get It: Financial Industry Regulatory Authority (FINRA) through their membership application process.

4. State Securities Registrations

In addition to federal regulations, you may need to comply with state securities laws, known as “blue sky laws.” These laws vary by state and may require registration or exemption filings for your platform to offer securities to residents of those states.

Where to Get It: State securities regulator’s office for each state in which you plan to operate. The North American Securities Administrators Association (NASAA) provides contact information for state securities regulators.

5. Real Estate Broker License

If your crowdfunding platform involves managing real estate transactions directly or providing certain types of advice on real estate investments, you might need a real estate broker license.

Where to Get It: State real estate commission or board. Requirements vary by state but typically involve completing education courses, passing an exam, and submitting an application.

6. Anti-Money Laundering (AML) Compliance

While not a license or permit per se, it’s crucial for real estate crowdfunding platforms to establish AML compliance programs to prevent, detect, and report potentially suspicious activities.

This may involve registering with the Financial Crimes Enforcement Network (FinCEN) and implementing systems to monitor transactions for money laundering activities.

Where to Get It: Financial Crimes Enforcement Network (FinCEN), part of the U.S. Department of the Treasury.

Step 4: Build Your Platform

Developing a user-friendly, secure website is crucial for your crowdfunding platform. Your site should offer easy navigation for users to browse investment opportunities, create accounts, and manage their investments.

For a crowdfunding platform to operate efficiently and meet the needs of its users, certain functionalities are essential. Here are the key functionalities that are a must for a crowdfunding platform:

- Account Creation and Management: Users should be able to easily create, edit, and manage their accounts, setting preferences and accessing their transaction history.

- Project Submission and Editing: Provide a streamlined process for users to submit new projects for crowdfunding, including tools for editing and updating their projects as needed.

- Funding Goal Tracking: Projects should display a clear funding goal, with a real-time tracker showing the current amount raised versus the target, to motivate contributions and provide transparency.

- Secure Payment Processing: Implement a secure and efficient payment processing system that supports multiple currencies and payment methods, ensuring safe transactions for backers and recipients.

- Communication Channels: Facilitate communication between project creators and backers through messaging systems, comment sections, and updates, enhancing engagement and transparency.

- Search and Discovery: Offer robust search and filtering tools that allow users to easily discover projects that match their interests, investment criteria, or philanthropic goals.

- Social Sharing: Integrate social media sharing tools to enable users to spread the word about projects they support, driving visibility and contributions.

- Rewards or Equity Management: For reward-based or equity crowdfunding platforms, provide tools for managing and distributing rewards or handling equity share documentation and agreements.

- Regulatory Compliance and Reporting: Include functionalities for handling regulatory requirements, such as investor accreditation checks for equity crowdfunding, and reporting tools for financial and campaign performance analysis.

- User Feedback and Ratings: Allow users to provide feedback and rate projects or platform experiences, fostering a community-driven approach to quality and trustworthiness.

- Multi-Language Support: To cater to a global audience, offer multi-language support, making the platform accessible to users from different linguistic backgrounds.

Platform Backend and Project Management

To ensure the effective management of crowdfunding campaigns, a platform must feature a robust backend.

This includes tools for project and user management, a dashboard for at-a-glance monitoring of performance, payment logs, and a message board for communications between project creators and the platform administrators.

These tools facilitate easier tracking of campaign success, fund management, and communication with donors or investors.

Payment and Marketing Integration

Selecting and integrating versatile payment gateways is crucial for accommodating the diverse needs of global users.

The platform should allow for easy setup and management of various payment gateways, reflecting on the importance of flexibility in payment processing.

Additionally, the inclusion of marketing tools—such as customizable templates for promotional messages and interfaces for SMS and email campaign management—can significantly amplify the platform’s ability to reach and engage potential backers.

Accountability and Transparency

Platforms need to foster an environment of trust and openness by encouraging project creators to be transparent about their progress and financials.

Features that facilitate regular updates to backers and allow for open communication channels between creators and their supporters are vital.

This transparency helps in building and maintaining trust, which is paramount for the success of any crowdfunding campaign.

Business Model Flexibility

A successful crowdfunding platform must be adaptable to support various crowdfunding models, including equity, pledge, donation, debt, and real estate crowdfunding.

This flexibility is essential to cater to the diverse needs and goals of project creators and investors, allowing for tailored fundraising strategies that best fit each campaign’s unique circumstances.

Get a virtual office service to get access to flexible workspace and avoid the hassle of leasing.

Step 5: Source Real Estate Projects

Your platform’s success depends on the quality and diversity of real estate projects it offers.

Establish relationships with property developers, real estate investment trusts (REITs), and individual property owners.

Vet each project thoroughly to ensure it meets your platform’s criteria for profitability and risk.

Sourcing real estate projects for a crowdfunding platform involves a strategic approach to identifying and securing investment opportunities that align with your platform’s goals and investor interests. Here’s a streamlined process:

- Network with Industry Professionals: Establish relationships with real estate developers, agents, brokers, and investment firms. These connections can provide a steady stream of potential projects.

- Attend Real Estate Events: Participate in real estate conferences, seminars, and networking events to meet project owners and developers looking for funding.

- Online Marketplaces and Listings: Regularly scour online real estate marketplaces, listings, and forums for potential investment opportunities that could be suitable for crowdfunding.

- Partnerships: Form strategic partnerships with real estate development companies or investment firms to gain early access to projects before they hit the open market.

- Direct Outreach: Contact property owners directly who may be interested in crowdfunding as an alternative financing method for their projects.

- Utilize Technology: Leverage technology and data analytics to identify emerging markets and undervalued properties that offer good investment potential.

- Screen and Due Diligence: Implement a rigorous screening process to assess the viability, profitability, and risk of each project. Conduct thorough due diligence on the property, developer, and market conditions.

Step 6: Marketing and Launch

Calculate your business expenses here:

Budget Calculator

With your platform built and projects lined up, focus on marketing to attract investors and real estate developers.

Use SEO strategies to rank for keywords such as “how to crowdfund real estate,” “real estate investing crowdfunding,” and “crowdfunding for real estate investments.”

Leverage social media, content marketing, and targeted advertising to build awareness and credibility for your platform.

To effectively market a real estate crowdfunding business, a blend of digital marketing strategies and relationship building is essential. Here are some strategies to consider:

- Content Marketing: Create valuable, informative content that demystifies real estate crowdfunding for potential investors. Use blogs, ebooks, and webinars to educate your audience about the benefits and processes of crowdfunding real estate investments.

- SEO (Search Engine Optimization): Optimize your website and content with relevant keywords such as “how to crowdfund real estate” and “real estate crowdfunding USA” to improve visibility on search engines and attract organic traffic.

- Social Media Marketing: Leverage platforms like LinkedIn, Twitter, and Instagram to share success stories, investment opportunities, and market insights. Engage with your audience to build trust and authority in the real estate crowdfunding space.

- Email Marketing: Develop a segmented email list to send personalized updates, investment opportunities, and educational content to potential and current investors. This helps nurture leads and retain investor engagement.

- Paid Advertising: Utilize targeted ads on Google and social media platforms to reach potential investors actively searching for real estate investment opportunities. Consider retargeting ads to re-engage visitors to your website.

- Partnerships and Networking: Build relationships with real estate developers, investment clubs, and financial advisors to expand your reach. Partnering with established players can lend credibility and bring in new investors.

- Investor Events and Webinars: Host events and online webinars to connect directly with potential investors. These can be educational or focused on showcasing new investment opportunities, providing a platform for Q&A and direct interaction.

FAQs

- What is real estate crowdfunding?

It’s a way for individuals to invest collectively in real estate projects via online platforms. - How do I start a real estate crowdfunding platform?

Identify your market, ensure legal compliance, develop your platform, source projects, and market your platform.

- What are the legal requirements for real estate crowdfunding in the USA?

Register with the SEC, follow the JOBS Act regulations, and ensure state-level compliance.

- Can I compete with CrowdStreet and other platforms?

Yes, by offering unique value, focusing on niche markets, and providing superior user experience.

- What are the best real estate crowdfunding websites?

Examples include CrowdStreet, Fundrise, and RealtyMogul, known for diverse real estate investment opportunities. - How can I attract investors to my platform?

Use SEO, content marketing, social media, and network within the real estate community to build visibility.

- What kind of real estate projects can be crowdfunded?

Residential, commercial, and industrial projects are all viable options for crowdfunding.

- How important is technology in real estate crowdfunding?

Critical for providing a secure, efficient, and user-friendly platform for investors and developers.