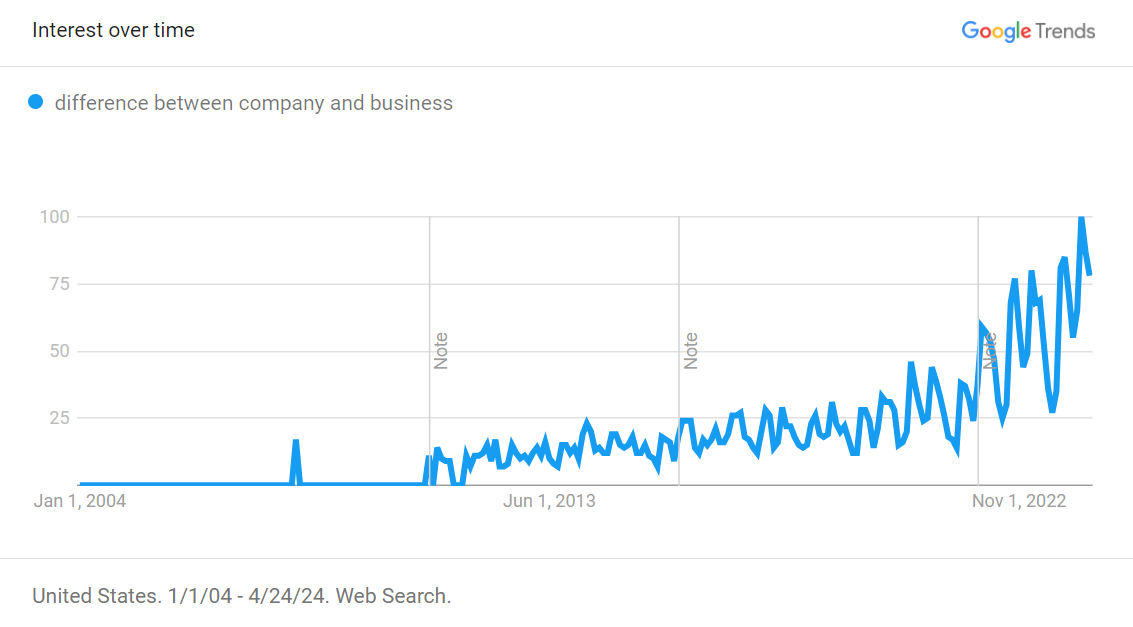

Understanding the difference between a company and a business is essential, as it lays the groundwork for various legal, operational, and financial aspects.

In the corporate world, these terms are often used interchangeably, but they have distinct meanings and implications.

Regardless of the type of business you’re looking to step into, here are some of the basics you should know to maximize your profit.

Legal Structure

One of the fundamental differences between a company and a business lies in their legal structure.

A company is a legal entity formed under the laws of a particular jurisdiction, often with limited liability protection for its shareholders.

On the other hand, a business can refer to any entity engaged in commercial, industrial, or professional activities, which may or may not be registered as a separate legal entity.

Find Out More: What Is the Legal Environment of Business? A Complete Guide

Generally, the different legal structures associated with a company or business are as follows:

Legal Structure of Companies

Corporation (Corp)

Corporations are distinct legal entities separate from their owners (shareholders). They offer limited liability protection to shareholders, meaning shareholders’ personal assets are generally shielded from the company’s debts and legal obligations.

Corporations issue shares of stock and are governed by corporate laws and regulations. For instance, multinational companies like Apple Inc. and Microsoft are corporations.

Limited Liability Company (LLC)

LLCs combine the limited liability protection of a corporation with the flexibility of a partnership. LLC owners, known as members, enjoy limited liability similar to shareholders in a corporation.

LLCs can choose to be taxed as pass-through entities or as corporations. Most small businesses, startups, and real estate ventures are LLCs as it is considered one of the safest legal structures for companies.

Legal Structure of Businesses

Sole Proprietorship

Sole proprietorships are the simplest form of business structure, owned and operated by a single individual. The owner assumes all liability for the business’s debts and obligations.

Sole proprietorships are not considered separate legal entities. Freelance writers, consultants, home-based business, and small retail shops are all sole proprietorships.

Partnership

Partnerships involve two or more individuals or entities sharing ownership of a business and its profits and losses.

Partnerships can be general partnerships (GP), where all partners have unlimited liability, or limited partnerships(LP), where at least one partner has limited liability. Examples of partnerships include law firms, accounting firms, and small family businesses.

Limited Liability Partnership (LLP)

LLPs are partnerships in which some or all partners have limited liability, similar to shareholders in a corporation.

LLPs are often used by professional service firms, such as law firms and accounting firms, to protect partners from personal liability arising from the actions of other partners.

Cooperative (Co-op)

Cooperatives are businesses owned and democratically controlled by their members, who may be customers, employees, or suppliers.

Cooperatives operate based on principles of self-help, democracy, equality, and solidarity. For instance, credit unions, agricultural cooperatives, and consumer cooperatives.

Nonprofit Organization

Nonprofit organizations are business entities that operate for the benefit of the public or a specific group of people, rather than to generate profit for owners or shareholders.

Nonprofits can take various legal forms and are exempt from paying taxes on their income. Charities, foundations, religious organizations, and many educational institutions are based on this legal structure.

Ownership

Ownership arrangements differ significantly between companies and businesses. It is dependent directly on the legal structure of the entity.

In a company, ownership is typically represented by shares of stock, which can be publicly traded or privately held. Shareholders own a portion of the company based on the number of shares they hold.

Publicly traded companies list their shares on stock exchanges, allowing anyone to buy and sell shares on the open market. Privately held companies, on the other hand, do not offer their shares for public trading and are owned by a smaller group of investors or individuals.

Shareholders may include individual investors, institutional investors, mutual funds, and other corporations.

In contrast, ownership of a business can be sole proprietorship, partnership, or corporation, where individuals or entities have direct ownership stakes.

Purpose

Companies and businesses often have distinct purposes.

While companies are primarily focused on generating profits for their shareholders, businesses may prioritize fulfilling a specific need in the market, providing a service, or pursuing social or environmental objectives alongside profitability.

The primary purpose of companies is often profit maximization. Companies aim to generate revenue and increase shareholder value by providing goods or services in the market. On the other hand, the primary purpose of businesses is to fulfill specific needs or demands in the market. Businesses identify opportunities to provide goods or services that address consumer preferences, solve problems, or meet unmet needs.

Companies are legally obligated to act in the best interests of their shareholders. Shareholders, who own shares of stock in the company, expect returns on their investment in the form of dividends, capital appreciation, or both. Businesses, on the other hand, create value by providing high-quality products or services, delivering exceptional customer service, or fostering innovation and creativity.

Size

Companies tend to be larger in scale, with extensive operations, multiple divisions, and a global presence in some cases.

Businesses, on the other hand, can range from small startups to medium-sized enterprises, catering to niche markets or serving local communities.

Companies

Large Corporations: Employ thousands or hundreds of thousands of people globally (e.g., Apple, Google).

Medium-Sized Enterprises (SMEs): Typically employ hundreds to thousands of people regionally or nationally.

Small Businesses: Employ fewer than 100 people, often serving niche markets locally (e.g., family-owned restaurants, boutique shops).

Businesses

Sole Proprietorships: Often small-scale operations with the owner as the sole employee or a small team.

Partnerships: Can vary in size, with small law or accounting firms employing a few to hundreds of professionals.

Entrepreneurial Ventures: Start small, often with a few employees or just the founder (e.g., tech startups).

Microenterprises: Operated by a single individual or a small team, with fewer than five employees (e.g., neighborhood cafes, independent retail stores).

Liability

Liability implications differ based on the legal structure of companies and businesses.

In a company, shareholders typically have limited liability, meaning their personal assets are protected from the company’s debts and liabilities.

Companies are considered separate legal entities from their owners (shareholders). This separation ensures that the company’s debts and legal liabilities are distinct from those of its shareholders.

The principle of the corporate veil further reinforces the separation between the company and its shareholders. It shields shareholders from personal liability for the company’s actions or debts, provided that they have not engaged in fraudulent or wrongful conduct.

In contrast, owners of businesses such as sole proprietorships and partnerships may have unlimited personal liability, exposing their assets to business-related risks.

This means that creditors can pursue the owner’s personal assets to satisfy business debts.

Operational Structure

The operational structure of companies and businesses can vary in complexity and hierarchy. Companies often have formalized organizational structures with departments, management levels, and reporting mechanisms.

Companies may organize their operations into various departments or divisions based on functions, although decision-making authority is centralized at the top levels of management.

Businesses may have a more fluid organizational setup, especially in smaller enterprises, where decision-making is centralized, and roles are multifaceted.

They adopt flat or decentralized organizational structures with fewer layers of management and more autonomy for employees. Flat structures promote open communication, empowerment, and collaboration among team members, fostering a culture of innovation and initiative.

The owners often play a hands-on role in day-to-day operations, decision-making, and strategic planning. Businesses stick to adaptive processes because their primary purpose is to drive value by focusing on customer satisfaction.

Financial Reporting

Companies are usually subject to stricter financial reporting requirements compared to businesses. Publicly traded companies are required to disclose financial information regularly to regulatory authorities and shareholders, ensuring transparency and accountability.

Businesses, especially smaller ones, have less stringent reporting obligations, depending on their legal status and size.

Depending on the type of company, they must report their finances to the following entities:

Regulatory Authorities

Companies are required to financially report to regulatory authorities, which vary depending on the jurisdiction and the company’s legal structure.

In the United States, publicly traded companies must file regular financial reports with the Securities and Exchange Commission (SEC).

In other countries, companies may report to similar regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the European Securities and Markets Authority (ESMA) in the European Union.

Stock Exchanges

Publicly traded companies listed on stock exchanges are often required to disclose financial information to the exchange where their shares are traded.

Stock exchanges typically have listing requirements that mandate companies to regularly report financial results, corporate governance practices, and other material information to shareholders and investors.

Annual Reports

Companies are generally required to prepare and distribute annual reports to shareholders, providing a comprehensive overview of the company’s financial performance, operations, and strategic outlook.

Annual reports typically include financial statements such as the income statement, balance sheet, cash flow statement, and notes to the financial statements.

Quarterly Reports

Publicly traded companies often issue quarterly reports, also known as quarterly earnings reports or quarterly filings, to update shareholders and investors on their financial results and business performance.

Quarterly reports typically include condensed financial statements, management discussions and analysis (MD&A), and key performance indicators for the quarter.

Interim Reports

In addition to annual and quarterly reports, some companies may issue interim reports or updates to provide stakeholders with timely information on significant events, developments, or changes affecting the company’s financial position or operations.

Interim reports may be required by regulatory authorities or stock exchanges in certain jurisdictions.

Audited Financial Statements

Companies often engage external auditors to audit their financial statements and provide an independent opinion on their accuracy and compliance with accounting standards and regulatory requirements.

Audited financial statements are typically included in annual reports and provide assurance to shareholders, investors, creditors, and other stakeholders regarding the reliability of the company’s financial information.

Regulation

Regulatory oversight differs for companies and businesses, influenced by their legal structures and activities.

Companies are subject to various regulations governing corporate governance, securities trading, and financial reporting, aimed at safeguarding the interests of shareholders and the public.

Businesses may face regulatory requirements specific to their industry or location but generally have fewer compliance obligations compared to companies.

We’ve enlisted a few of the regulations and businesses and companies of various forms and structures must adhere to for proper and seamless functioning.

Tax Regulations

Tax regulations govern corporate income tax, value-added tax (VAT), payroll tax, and other taxes applicable to business activities. These are imposed by local, state/provincial, and national governments.

Environmental Regulations

Companies must adhere to environmental regulations governing pollution control, waste management, resource conservation, and environmental sustainability.

Financial Regulations

Companies, especially publicly traded ones, are subject to financial regulations governing accounting standards, financial reporting, and disclosure requirements.

Data Protection Regulations

Data protection regulations, governing the collection, use, storage, and sharing of personal data., such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States, aim to protect individuals’ privacy rights and prevent data breaches.

Intellectual Property Regulations

Companies must respect intellectual property regulations governing patents, trademarks, copyrights, and trade secrets.

Industry-Specific Regulatory Compliance

Companies are subject to industry-specific regulations and regulatory compliance requirements imposed by government agencies, regulatory bodies, and industry associations.

Employment Regulations

Businesses must comply with employment regulations concerning hiring, wages, working hours, workplace safety, and employee rights.

Employment regulations include laws such as the Fair Labor Standards Act (FLSA) in the United States and the Employment Standards Act in Canada.

Consumer Protection Regulations

Businesses must comply with consumer protection regulations aimed at safeguarding consumers’ rights, ensuring product safety, and preventing fraudulent or deceptive practices.

Consumer protection regulations include laws such as the Consumer Protection Act in the United States and the Consumer Rights Act in the United Kingdom.

Taxation

Taxation is another area where companies and businesses diverge.

Companies are subject to corporate income tax on their profits, with tax rates varying based on jurisdiction and corporate structure.

Businesses, depending on their legal form, may be taxed differently. Sole proprietorships and partnerships are typically taxed at the individual level, while corporations are subject to corporate tax rates.

Taxes are collected by one of the three following entities in the USA. The legal structure of the business or company determines who the collector will be.

Internal Revenue Service (IRS)

- The IRS is the federal agency responsible for collecting taxes at the national level.

- Federal income taxes, payroll taxes (such as Social Security and Medicare taxes), and corporate taxes are collected by the IRS.

- Taxpayers, including individuals, businesses, and organizations, are required to file annual tax returns with the IRS by April 15th of each year, reporting their income, deductions, and credits for the previous tax year.

- Quarterly estimated tax payments may also be required for individuals and businesses that expect to owe a certain amount of tax for the current tax year.

State Revenue Departments

- State revenue departments or tax agencies are responsible for collecting state taxes, including income taxes, sales taxes, and business taxes.

- Each state sets its own tax rates, deductions, and filing deadlines for state income taxes.

- Taxpayers must file state tax returns and make payments to the appropriate state revenue department based on the specific requirements of their state of residence or business location.

- State tax filing deadlines vary by state but generally align with the federal tax filing deadline of April 15th.

Local Tax Authorities

- Some local jurisdictions, such as cities and counties, may impose additional taxes on residents and businesses, such as property taxes, local income taxes, or sales taxes.

- Local tax authorities administer and collect these taxes according to their respective local tax laws and regulations.

- Taxpayers must comply with local tax requirements and deadlines as specified by their local tax authorities.

FAQs

- Are all companies considered businesses?

While all companies engage in commercial activities, not all businesses are structured as separate legal entities. Some businesses, such as sole proprietorships and partnerships, may not be formally registered as companies.

- Can a business be a company?

Yes, a business can be structured as a company by registering as a corporation or limited liability company (LLC) under the applicable laws and regulations.

- Do companies pay taxes differently from businesses?

Yes, companies are subject to corporate income tax on their profits, while businesses may be taxed differently based on their legal structure and jurisdiction.

- What are the advantages of forming a company over a business?

Forming a company can provide limited liability protection to shareholders, access to capital markets for fundraising, and enhanced credibility in the eyes of customers, suppliers, and investors.

- How do branding strategies differ between companies and businesses?

Companies often invest more resources in branding to create a distinct identity, build brand equity, and differentiate themselves from competitors. Businesses may focus on personalized service, niche expertise, or local community engagement to establish their brand presence.